Amazon offers two primary modes of selling products on their platform: the Vendor program, also known as 1st Party or 1P, and as a Marketplace seller, known as 3rd Party or 3P.

Both have their pros and cons, and we have discussed the two models in depth in a past article. Here’s a quick summary:

Vendor Program

Brands sell to Amazon directly, on a wholesale basis - filling purchase orders that Amazon initiates.

Major benefits:

- Very low administrative and operations load - Amazon handles everything from warehousing inventory, to order fulfillment, to all customer service

- Familiar wholesale model, brands can simply treat the Amazon channel the same as other wholesale customers

- Access to enhanced advertising and marketing features via Amazon Marketing Services (AMS), plus other promotional services like the Vine Reviewer program

Major challenges:

- Potential for channel conflict caused by Amazon offering lowest available price online. Brands cannot enforce MAP with Amazon

- Potentially less margin compared to the retail model

- Amazon’s pricing and purchasing process/system may not support adequate depth or selection for a brand

- Fewer performance metrics and analytics available in the Vendor portal

Marketplace Seller (3P)

- Brands use Amazon as a platform or marketplace to sell directly to customers.

Major benefits:

- Ability to use the “Fulfilled By Amazon” program whereby Amazon will warehouse inventory, fulfill orders, and handle most customer service inquiries related to order fulfillment

- Potentially better margins: brands pay Amazon a 15% referral fee on each sale (for most categories), plus fulfillment fees which can be as low as around $4 for small and light items. This is in contrast to the typical wholesale model where Amazon might pay 50% or less of the retail price

- Better reporting and analytics in the Seller portal, to see what’s working and what’s not

Major challenges:

- Less robust PPC (pay per click advertising) tools, compared with AMS

- More of the administrative and operational burden falls on the Seller - some customer service still required

Want to learn more about the Vendor program and how to use it effectively? Register for our free training course.

Looking at all the pros and cons of each model, some Vendors might be seeing the 3P model as being pretty attractive - after all, you could potentially get better margins, better control of pricing in the channel, and also control SKU depth and selection more proactively than your Vendor Manager or the Vendor Express computer algorithm currently does.

Some 3P Sellers are tempted by the more robust advertising and promotional options afforded through AMS, and also the most hands-off model of selling to Amazon using a wholesale model. There also seems to be less risk of Amazon suspending product listings (or even your account) when the brand has a direct relationship with Amazon. Many sellers have had scary experiences where Amazon has threatened to close their listings after too many customer quality complaints (whether those complaints are warranted or not), late shipments, or other factors which often fall outside the brands’ control.

A couple of our clients have even gotten into hot water when Amazon themselves mislabeled their inventory at their fulfillment center, meaning that customers received the wrong product. When customers complained about this, Amazon promptly suspended the listings due to quality issues - even though it was their fault. It took weeks of appeals and follow-ups with Seller Support to resolve the issue. Vendors don’t have to worry about these kinds of issues cropping up because Amazon owns the inventory that it has purchased from the brand - making it their property (and their problem).

So, is it possible to operate both a Seller and Vendor account?

Yes, it is possible to operate both accounts. One prominent brand which follows this model is Steve Madden shoes.

A Hybrid model in action

Steven Madden, the behemoth fast-fashion shoe company, had a 1P relationship with Amazon

In 2016 they started using a 3P model as well as 1P. The onboarding wasn’t what you’d call altogether smooth, though. Says Mark Friedman, President of Ecommerce at Steve Madden in a recent interview on the Jason and Scot podcast:

“It’s Amazon, they’re big, they should know how to get this done, it should be turn-key. It certainly was not turn-key and took a long time to get it going right and often it feels like they’re learning at the same time as we’re learning.”

This is a challenge that we talk about on many consultation calls with prospective clients of Bobsled Marketing: they know the potential of selling on Amazon is huge, but feel like they are missing any kind of hands-on support from Amazon themselves when trying to navigate and interpret their platform.

Does this sound like you? Contact us for a consultation to see how we might be able to help.

Amazon’s marketplace and wholesale teams don’t seem to talk to each other, even from a technology and process perspective. I have even heard from a new seller who is being courted simultaneously by different teams at Amazon who wanted the brand to debut in “their” area.

Steve Madden has an interesting approach to the 3P side of the relationship. They do not use FBA (Fulfillment By Amazon), instead, they use the Merchant-Fulfilled option to actually ship orders directly to the customer - either from their warehouses and even their retail stores where it makes sense. They use advanced algorithms which determine which locations an order should be shipped from. This is based on factors like proximity to customer, carrier rates, and cost to fulfill (retail stores generally having higher labor costs than warehouses). Mark Friedman gave an example where they might pick, pack and ship an order for a customer in New York from their California warehouse, because the cost of taking someone a sales person “off the floor” of a retail store in New York, combined with the volume discounts from UPS, would actually make it more expensive to fill that order than from a dedicated warehouse on the other side of the country.

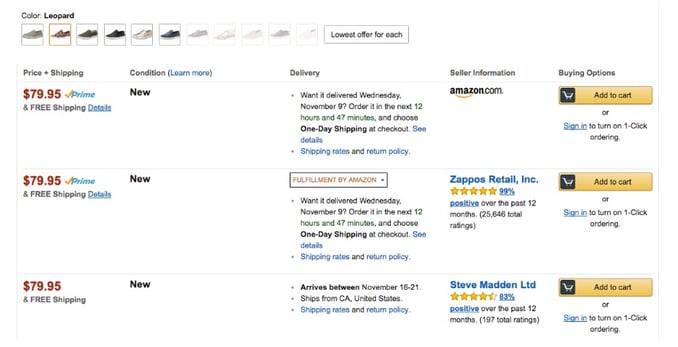

Above: a product page on Amazon for Steve Madden, where Amazon is selling directly (as 1P), as well as Zappos (using the FBA model), and Steve Madden Ltd (using the 3P Merchant-Fulfilled model).

Above: a product page on Amazon for Steve Madden, where Amazon is selling directly (as 1P), as well as Zappos (using the FBA model), and Steve Madden Ltd (using the 3P Merchant-Fulfilled model).Not all brands will have as significant a store footprint as Steve Madden, so many brands will opt for using the FBA model and have Amazon take care of warehousing, picking, packing, and shipping their orders.

How to maximize a hybrid selling model,

using both a Seller Central and Vendor Amazon account

Here are some use cases for brands considering a hybrid approach.

1. Splitting product ranges

A current Bobsled Marketing client in the jeans category was selling their girls’ jeans assortment to Amazon on a 1P basis but was frustrated with the channel conflict this caused. Amazon was often pricing SKUs below MAP, which caused some channel conflict for their other major retail partners. Amazon was also not purchasing adequate inventory across all SKUs, so often certain sizes would be out of stock on Amazon.

After conducting a study to determine the margin impact of switching to a 3P model, we are currently supporting a trialed hybrid approach for this client. They have launched their Womens’ Jeans range on Amazon under the FBA model. This will allow the client to maintain pricing where they want it to be, attract more margin on each sale, and do a better comparison of each model.

2. Use different models in international markets.

International expansion is an attractive growth opportunity for many brands, and Amazon makes it relatively simple to start exploring new markets like Canada, the UK, and Europe.

Some brands might prefer to use the Vendor option in new markets because Amazon will take care of all the local regulatory compliance and tax concerns when they purchase inventory from you.

Conversely, some brands might see an opportunity to branch out into new markets more rapidly, and on their own terms, if they take a more proactive approach as a 3rd Party merchant.

3. Leveraging AMS and other Vendor programs

If accessing the enhanced paid advertising placements available through AMS (Amazon Marketing Services) is a priority, it could be worthwhile to initiate a Vendor relationship. Brands can pick and choose which SKUs are sold to Amazon directly, based on profit margins and other factors. Brands can then access advanced ad placements like headline ads and product display ads, which are not available in Seller Central.

Do note that Amazon probably doesn’t want you to be selling the same SKUs in a 3P model as a 1P model, but there seems to be no mechanism for preventing it. You’ll also have to consider potential penalties from Amazon’s Vendor team if they are consistently losing the ‘Buy Box’ to a 3rd party merchant (which may potentially be your brand).

Other programs which are interesting to brands include the Amazon Vine program, which is only available to Vendors. In this program, brands can pay to tap into Amazon’s network of reputable product reviewers, increasing the number of product reviews on a page. Product reviews can have a dramatic effect on sales conversion rates.

In summary…

There are many pros and cons to both the Seller (3P) and Vendor (1P) programs on Amazon, and it can be difficult to really get a handle on which is right for your brand.

In this article, I reviewed some used cases from real brands, as well as some potential ways to explore a hybrid model and use both programs to your advantage.

Bobsled Marketing works with both Vendors and Merchants to maximize their reach and revenue on Amazon. We can help you to navigate a hybrid Vendor/Seller presence on Amazon, or optimize your sales strategy on their platform. Contact us for a consultation today.

.png)