I’m lucky to count an experienced CPA as a friend. Not just that, but one who’s willing to shoot the breeze about such a lighthearted and enjoyable topic as the ins and outs of sales tax collection requirements for Amazon FBA sellers!

Mario Lucibello from Greenhaus Riordan & Company, a professional Accounting firm that’s been in business since the 1920s, which deals with everything from Mom & Pop shops to $100 million companies. E-Commerce and selling on Amazon in particular present challenges for business owners, because the legal and tax rules that still govern us were written to address businesses in a much earlier (non-digital) era.

As such, many e-commerce brands and FBA sellers have unanswered questions on such matters as sales tax. So I cornered Mario recently and asked his perspective on some commonly asked questions by Amazon sellers.

Inventory & Tax Nexus for Amazon Sellers

The Unites States sales tax system was originally designed for brick and mortar businesses like stores and restaurants where merchants would collect sales tax from each patron or customer - it was pretty simple.

The rapid uptake of e-commerce means that buyers & sellers are frequently not located in the same state. So the onus is on the seller to determine whether they are liable to collect and pay sales tax on each purchase, based on the buyer’s shipping address and if they have a presence in that State which constitutes a “tax nexus”. A presence could include an office, warehouse, employees, or contracted agents. And most importantly for merchants, owning inventory in any particular State often creates a “tax nexus” for your business, meaning that you must start collecting and remitting tax on sales to customers in that State.

But each State has its own rules. Some have a sales tax provision and others don’t, some exclude Third Party Fulfillment Providers (3PLs) from their definition of a tax nexus, and some States have specific tax rates at the county-level, which is definitely not fun (speaking from personal experience with my own e-commerce business).

Mario kindly offered to share this State-by-State Tax Nexus Report which shows the surveyed results when state tax authorities are posed the question of whether or not 3PL arrangements create tax nexus within their state.

Sales tax consequences for Amazon FBA Sellers

The trouble for Amazon FBA sellers is they don’t have a lot of control over where their inventory is held. Amazon determines where your inventory should be routed to, within the dozens of Fulfillment Centers around the country. Suddenly, Sellers could have inventory in 15 or 20 States right out of the gate and by default, required to start collecting and remitting the applicable sales tax to each State.

So Sellers should first find out if they need to collect sales tax, and then how to do it. Most often, the company will need to file for approval to start collecting sales tax in that State, then start collecting the applicable tax on each purchase made by customers in that State. Don’t worry, we have some tips at the end of the article on how to make this easier.

What’s the worst that could happen if I don’t comply?

It’s tempting to consider what the true risk is of not going through the administrative pain of the initiation and ongoing compliance of sales tax in multiple jurisdictions, and just focusing on complying within your “home” state.

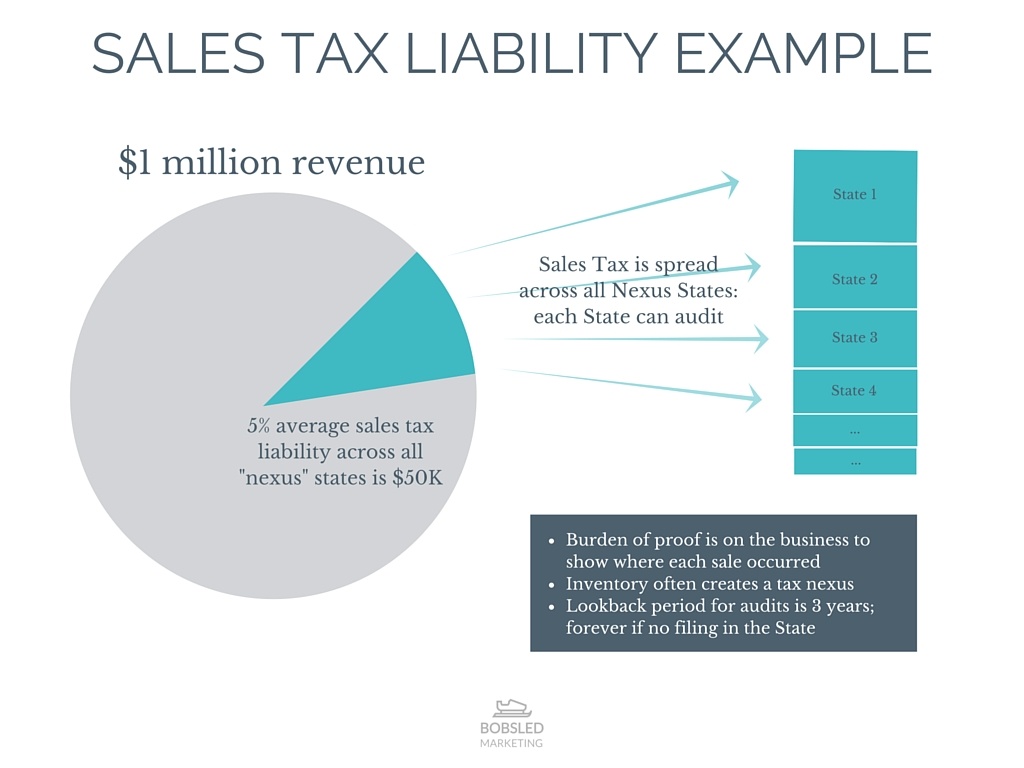

Mario lays out the following example.

A business with $1 million in annual gross sales, with a tax nexus in 20 States which have an average sales tax rate of 5%.

If they did not charge sales tax on $1m of sales, their total tax liability is $50,000 a year, spread across 20 States. Now, what is the likelihood of all 20 states auditing that company? Fairly low.

However, the liability does not stop at the most recent tax period. The company would be liable for repayment of sales tax (plus penalties and interest) for every year passed since the company last filed. And if the company had never filed a return in that state, the look-back period is since the date of company formation. If they had filed a return in that state, they can look back just 3 years.

Finally, in the event of an audit, the onus is on the seller to prove or disprove that all of the companies sales did not occur in that state.

So that $50K in overall tax liability could turn into something much worse if your business is in operation for many years and not keeping adequate records.

From a risk standpoint, you could significantly reduce your risk by collecting and filing in the States that you have a more significant presence in, and eliminate the risk by filing in all of them as soon as you have a nexus in that state.

Crystal ball predictions: will state sales tax

get easier (or go away)?

Since the requirements seem so unfriendly to e-commerce and create such an administrative burden, I asked Mario if he thought that the rules would one day change to be simpler.

Mario doesn’t think the sales tax laws themselves will change anytime soon. Perhaps one day the States will relinquish some of their powers and things like sales tax will be administered at the federal level (like GST in Australia, or VAT in the UK & EU). But this seems distant since states are extraordinarily reluctant to give up any powers they have to the federal government....not to mention the potential budget crisis they may have if they were to lose revenue

Shouldn’t Amazon collect sales tax for FBA Sellers?

Amazon argues that the FBA sellers are selling directly to the Amazon customer, so the onus is on the Seller to collect and remit sales tax. Amazon makes it clear in their Terms of Service that sellers are ultimately responsible for tax compliance.

But Mario offers a different perspective of many FBA sellers. Amazon makes it very clear that FBA sellers do not own the customer. FBA sellers only have access the customer email and you cannot contact Amazon’s customers unless the communication specifically relates to delivery of their order.

“In an audit, you would have at least a small argument that it was not a sale to ‘your’ customer, since that’s Amazon’s customer” and the sales tax burden should be on them. However, making your case in audit is often a lengthy time consuming (let's not forget expensive) process involving accounts, lawyers and sometimes court rooms.

It could be argued that the FBA process is less akin to drop shipping, and more like selling based on consignment. In consignment sales, the seller is required to comply with the tax collection, not the provider.

And if States are eager to collect on the tax that they are due, it might arguably be more effective to pursue Amazon rather than millions of small FBA sellers. However, Amazon does wield a lot of leverage not just with formidable legal representation, but with threatening to pull out their Fulfillment Centers in those States, and the thousands of jobs that each Fulfillment Center creates. Who would win? We don’t know but it is likely that this will happen at some point in the future.

International FBA Sellers & Sales Tax

I asked Mario about the tax situation for companies with no legal entity in the United States. Do they need to file State sales tax or income tax when selling via FBA on Amazon?

He sees this as a gray area. The Federal income tax applies to foreign sellers when you’re "engaged in a trade or business in the United States". But that is a pretty broad definition, especially for companies whose only link to the US is that they ship inventory to an Amazon warehouse to be sold to customers in America. Mario has seen professional opinions split on this topic. Some professionals take the position that if you don’t have any staff in the US, and your only connection to the US is a 3rd party independent contractor (such as Amazon, an independent Distributor, or other independent contractor), it could be argued that this agent is not dependent on your company and therefore you are net engaged in a US trade or business and not subject to US taxation.

However, other professionals take the position that since you are selling "regularly and continuously" to customers in the United States with inventory owned by you within the USA, they consider that to be "engaged in a US trade or business and subject to US tax. “These laws were drawn up for very different types of businesses. I’ve seen people go both ways.”

Now there is some good news for companies located in Treaty Countries such as Australia, the UK, and much of continental Europe. Federal income tax is only applicable for you if you have to have a physical presence in the US with employees.

Mario suggests that companies collect and file sales tax at a minimum. Most States have clear definitions of what constitutes a tax nexus, and most often that includes if inventory is held in their state.

Mitigate it: Automate it!

Of course the best way to mitigate risks are through good record-keeping!

Back up all your sales and order history in every marketplace (like Amazon) as well as your e-commerce store. Be sure to include the mailing address of each customer order, to prove where sales occurred in the event of an audit.

Why is this important? As mentioned previously, if audited, the burden is on YOU to prove to the state that ALL of your sales were not within their state. If you cannot prove it, the State auditing you will argue that 100% of your sales were within their state and you have no basis to argue otherwise. This will drastically reduce your exposure.

Software like Taxjar and Avalara are popular ways to organize the rates, how much to charge, how much you owe to each State each month. The nice thing is that both Taxjar and Avalara is that they integrate directly with Amazon, most online stores, and other marketplaces.

At the end of the day, running a business involves risk. Measuring the consequences of a risk event and the probability of it actually occurring. And with software that makes it relatively easy to comply with sales tax requirements, it might be worth the better sleep that you and your CPA will get at night.

Want to get in touch with Mario with a specific question about your business? Find his firm, Greenhouse Riordan & Company at www.greenhousriordan.com.

.png)