Amazon Prime Day 2023: The Results

Each year, Acadia puts together an Amazon Prime Day recap to sort through the flurry of sales and determine how clients performed, including what worked, what didn’t, and how it all compares to last year.

Project Manager João Couceiro da Costa and Senior Paid Media Manager Ross Walker dove into the topline numbers, annual participation, promotional strategies and what went wrong and right for this year’s Prime Day, which has proven to be another record-breaking year for the sales event.

This Prime Day proved it: brands that don’t participate are missing out. After last year’s concerns around the shaky economy, this year proved that people will hold out for deals and come in droves when they drop. Amazon said that it was the biggest Prime Day yet, with total sales volume on July 11-12 amounting to an estimated $12.9 billion, according to Insider Intelligence. Amazon doesn’t release its own Prime Day figures, but said the first day of the sale was its biggest ever, and that it sold 375 million items over two days.

More brands were all-in for Prime Day

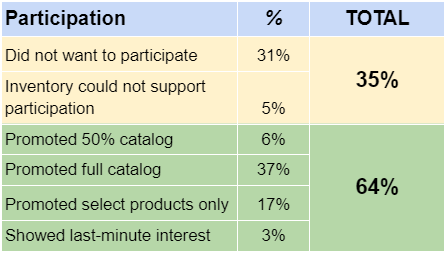

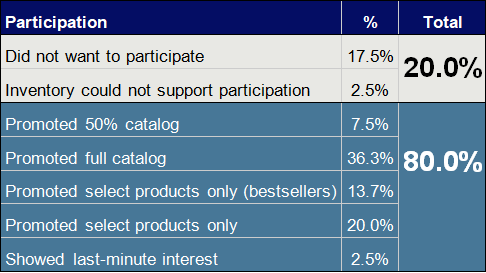

The key takeaway from this year was that brands were all in for Prime Day. This year, more clients participated in Prime Day, with 80% opting in, compared to 69% in 2022. Last year showed that when up against inflation and economic uncertainty – which is still lingering if more subdued than summer 2022 – customers want savings.

A greater portion of clients’ catalogs had deals running this year compared to last year as well, meaning not only did more brands pony up for Prime Day, but they were running more sales at once. 37% of Acadia clients opted to run deals on their entire product catalogs. The results showed that any level of Prime Day activity, no matter the promotion, led to a higher uptick in sales than not doing any promotions at all. One client that participated in the event saw a daily sales increase of 395% versus average daily sales in the period leading up to Prime Day. Not participating clients still saw a boost – but a much smaller one at that, at 51%.

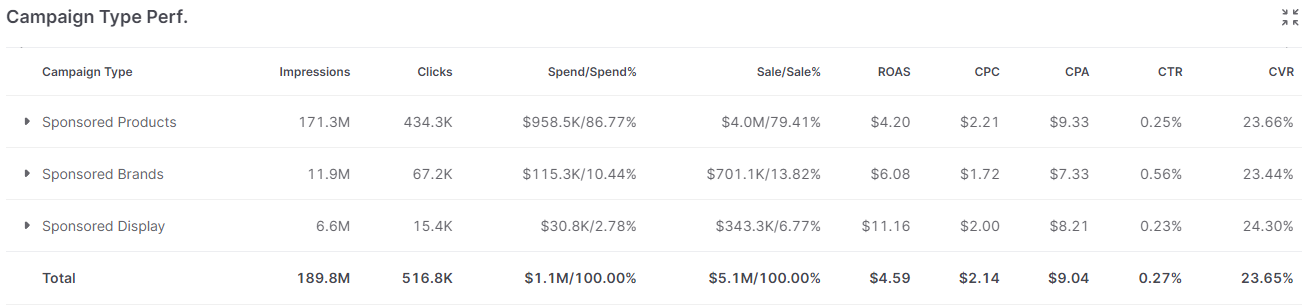

And with more clients offering more promotions, performance, and sales ticked up in turn. Acadia clients saw a cumulative $5.1 million in ad sales during Prime Day, an increase of 394% over last year. Spend was up 388%, meaning clients spent more to get a bigger return. (Another factor: Acadia’s client roster has grown.) That paid off: return on ad spend (ROAS) was up 12.8%, to $4.59.

Coupons for the win

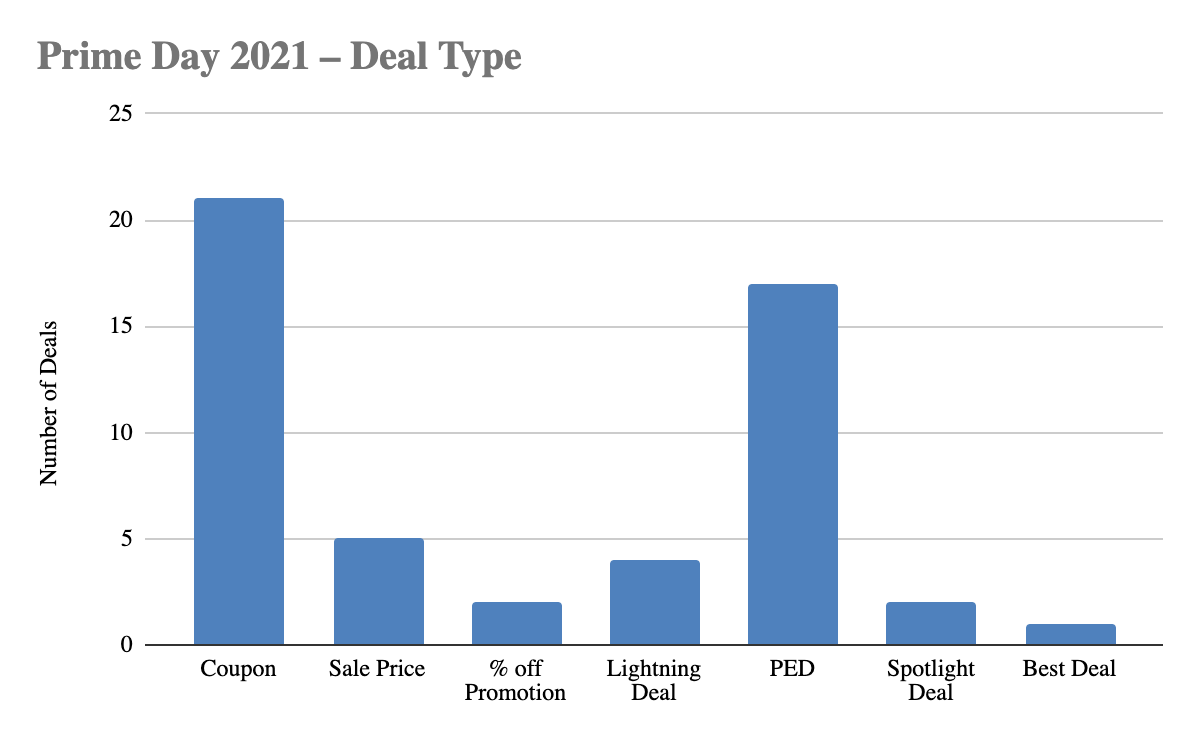

When it comes to the type of promotions that clients opted to run for Prime Day, simplicity was in favor. Coupons were the top-used promotion among Acadia clients, with 37.5% using coupons to push deals. Clients using coupons saw a 322% increase in daily sales compared to the daily average in the two-week lead up to Prime Day.

They’re also the easiest promotion, with percent-off deals beating out dollars-off deals. The gamut of the deal was spread across the entire spectrum, with clients offering anything between 5% and 75% off, so no matter how much you wanted to offer, coupons were an easy way to join Prime Day.

Prime-exclusive discounts (PEDs) were the second most popular promotion. Acadia recommended to clients in the lead up to Prime Day to offer both coupons and PEDs: sandwiching and stacking discounts can boost visibility and drive the best ROAS on Prime Day. The “sandwich” approach also functions to build up deals in the lead up to Prime Day, with the percentage off gradually increasing ahead of the sales event. PEDs improve ad performance, but coupons are best for incentivizing customers to buy, making them a winning combo.

The flashier deals, like lightning deals and spotlight deals, are smart bets – for the brands that can afford them. These placements cost more and can be trickier to navigate for sellers, which is something to keep in mind when debating which ad product to invest in. A more frictionless route particularly suited for brands with smaller budgets is to offer a straightforward percent-off promotion, which drives better results with less cost and hassle. Cross promotions, meanwhile, are too expensive and not very profitable – meaning smaller businesses can be edged out by deeper pockets.

This year, no major outages across ad types or glitches were reported on Prime Day, meaning those who set themselves up for success with big spend weren’t hurt by technical issues. But across categories, those playing in the same space as Amazon’s native brands – like Alexa, Echo and Amazon Basics – had a tougher time getting much visibility.

Advertising highlights

Acadia clients who participated in this year’s Prime Day were rewarded for emphasizing quality over quantity. Efficiency was higher than last year, with higher conversion rates.

- Ad spend rose 338% year on year, reflecting an annual trend in increased CPC of 30%.

- Conversion rose 23.6%, in step with spend.

- At the same time, ROAS was up, avoiding erosion thanks to higher overall prices and better conversion rates that offset higher costs.

- Competition was high, with big brands paying for prime real estate. Still, smaller brands saw considerable increases in average daily ad sales, so Prime Day is not yet completely saturated. Every year, there seems to be new brands who decide this is the year they’ll go all-in on Amazon.

At Acadia, we can help you devise a sophisticated advertising and creative plan to minimize the deterioration in your ACoS—and, better yet, set your brand up for long-term success. Get in touch with us for more.

PPC analysis

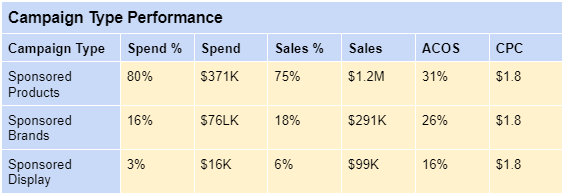

Sponsored products

Sponsored products were again Acadia clients’ top ad type overall, representing 86% of spend (up from 80% last year) and 79% of sales. Sponsored products also had the highest conversion rates. This is in line with Acadia’s recommendations: on Prime Day, above-the-fold visibility is key and a top-line position in search results can move the needle.

Acadia recommends securing sponsored product placement for the most important targets – including increasing bids and budgets to win that territory.

Sponsored brands

Second most popular among clients were sponsored brands, with an allocation of 11% (down from 16% last year) and 14% of sales. With more placements available compared to sponsored products, cost-per-click was lower in comparison. Conversion rates were similar, while ROAS was higher than sponsored products.

Acadia recommended pulling back on sponsored brand ads this year, since CPC and ROAS weren’t as strong compared to sponsored products. Sponsored brands do come into play in defensive marketing tactics, which include claiming brand territory in search results. Don’t let another brand steal your branded search page. A more specific approach and less generalized one works well for sponsored brand ads.

Other advertising highlights

- Manual keyword targeting was our clients’ No. 1 investment by targeting type this year.

- Sponsored brand product collection ad type was our top investment by spend when it came to sponsored brand ads.

- Compared to an average period last month, sales were up nearly 500%, while ROAS fell by 13.7%.

- Overall, costs are higher on Prime Day, but volume makes up for it.

Closing thoughts

With more participation in Prime Day this year, and competition always on the rise, this year’s sales event was a high stakes, high reward blowout as customers looked for deals and few reported issues kept things humming along.

How was your Prime Day? If your brand’s performance was underwhelming, we can help! Now is the time to get things right for BFCM and Q4.

Request a consultation with our team.

This recap was published on July 15, 2022. We keep our past years’ recaps online for future reference.

2022 Prime Day Recap

Each year, we provide a recap of how Prime Day performed for clients at Bobsled.

This year, Team Leader Armin Alispahic and Senior PPC Manager Ross Walker dive into overall participation, promotion strategies, quirks and issues during the event, and PPC strategies and results.

First, some external stats to set the context for this year, since there was some concern that spending would be down against the backdrop of inflation and a shaky economy, and that the deals offered by brands would not be as good.

- Amazon confirmed that 2022 was their biggest Prime Day event ever.

- Numerator data show that the average order size was higher than in 2021.

- Across the site, product prices were down by 3%, according to Results Imagery data (inflation-adjusted).

More brands opted to sit out Prime Day this year

Last year, 25.5% of Bobsled clients did not want to participate, compared with 31% this year. We shared earlier the reasons why. Many clients were struggling to justify price markdowns in an inflationary environment where their costs have not kept pace with prices.

But we did see a return to more stable inventory levels. In 2021, 11% of clients couldn’t participate in Prime Day simply because they didn’t have enough inventory to support it. That was only an issue for 5% of clients this year.

Promotion strategy

Most clients opted for percentage-off promotions, rather than dollar-off promotions.

Coupons, discounted sale prices, and Prime Exclusive Deals were the most popular promo types. Very few brands did special, paid deals (Lightning Deal, Spotlight Deal, Best Deal). The brands who opted for those paid deals were typically our larger clients. That said, these deals can work spectacularly well. One client who ran a spotlight deal saw $125K in sales from that deal alone (their typical account sales are $40K/day).

In terms of the discount amount, the majority opted for a discount between 20% and 30% off the regular price.

About 20% of brands decided to have a “sandwich” approach where promos are running before and after the event as well. The pre-event and post-event promos have smaller discounts than the main event promos. We like this strategy because it extends the event and improves conversion rates, at a time when you’re not competing with many other brands offering steep discounts at the same time. Did you miss this recommendation from us? We covered it on the blog a few weeks ago. Make sure you subscribe to our weekly newsletter to get these kinds of tips in the future!

Some clients tried not promoting their assortment and got burned on Day 1 of Prime Day (the ‘going dark” strategy). Some scrambled to introduce promos on day 2. The PPC team agrees that Prime Exclusive Discounts improved ad performance more than coupons.

Big issues with Prime Exclusive Deals and Coupons

Unfortunately, several clients experienced big issues with some promotions that were scheduled.

For one brand, Prime Exclusive Deals had been set up and were working at the start of the day. But then the deal just disappeared from the PDP. In haste, we set up coupons instead as there was no time to troubleshoot with Amazon support.

But coupons themselves were not immune. We experienced coupon glitches where everything was looking good in Seller Central, but were not showing on PDPs - We pivoted and created Price Reduction and got the discount notification to show on the PDP.

PPC issues experienced in 2022

Inevitably there are quirks and issues that also occur with ad campaigns. This year, we faced a number of hiccups.

The first issue was that Sponsored Brand ads had very long review times in some cases - 56 hours or more. This was isolated to a small number of clients, but frustrating nonetheless as these are helpful ad campaigns to have running pre-Prime Day, when shoppers are researching.

Secondly, Sponsored Brand ads scheduled to run only for the two Prime Days had a lot of trouble gaining impressions, even with high bids. It seemed to us that Amazon was throttling new campaigns or increasing the preference for campaigns with proven sales data.

We ran a test to check this. In the middle of day 1 with a client in the personal care category, we increased the budget of a new campaign and 10X-ed the average bid for the same keyword in an older campaign. Amazon still displayed the older campaign, but there were 0 impressions in the Prime Day campaign). The PD campaigns started to pick up afterward, but irrelevant numbers.

Recapping these issues and doing a “post-mortem” is an important part of our process at Bobsled Marketing. Before each major shopping event (Prime Day, BFCM, etc) we revisit these learnings and ensure there’s a contingency plan in place for each of them. We can’t predict what will go wrong each year, but we can have a plan that covers the most common scenarios!

Advertising highlights

Overall there were wonderful outcomes for clients who participated in Prime Day this year.

- One great outcome was the relative cost of advertising, it was down for our clients. Average ACOS was 12% lower than in prior days, compared to BFCM last year which saw ACOS increase by 20%. This all while average CPCs were up 13% from last year’s Prime Day.

- The conversion rate increased 44% this year compared to the previous days from 14% to 20%. On BFCM last year we saw an increase of only 23%.

- We saw a 300% increase in average ad sales compared to non-prime days in 2022.

- Overall, this felt like a Prime Day that was more competitive than ever and disrupted a lot by issues with promos mentioned above.

PPC strategies and performance

Sponsored Products

During the 2-day event, 80% of our ad spend was on Sponsored Products. This is not the typical ratio of ad spend but these are lower-funnel ad units that spur purchases. So after the pre-Prime Day groundwork has been laid to build awareness and consideration, we double down on Sponsored Product ads.

ACOS was actually highest for this ad type, but that was skewed by a greater amount of non-branded spending going into SP campaigns that have the most reach.

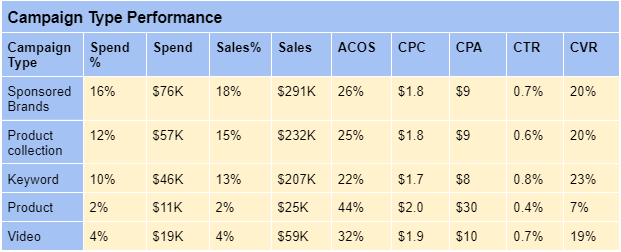

Sponsored Brands

16% of ad spend was on Sponsored Brands.

Keyword targeting SB ads had the best ACOS and CPC performance and took the lion's share of our SB to spend. Video SB type had only 4% of our spend because of its lower reach, but it outperformed the product targeting type in terms of CPC and ACOS with a better CVR.

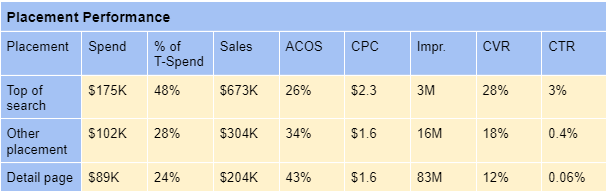

Placement

We allocated 47% of ad spend to ‘Top of search’ placement. This had the best CVR, CTR, and ACOS performance.

Other advertising takeaways

- ACOS was 10% higher on day 2 than on day 1

- CVR was flat both days

- CPC was slightly higher on day 2 - likely fewer shoppers and the same amount of advertisers competing driving up CPC

- Strong discounts combined with automatic campaigns performed quite well

Closing thoughts

We saw huge growth with some of our premium brand clients - discounts on premium-priced products seem to be something customers have been on the lookout for.

Generally, the majority of brands are seeing 2-4x in sales on Day 1.

We saw low to no uptick in sales for most brands that didn’t promote their products. (suggested further reading on “going dark” on Prime Day from our colleague Damiano)

New To Brand is a metric that we like to track, which shows what it says - how many sales were to customers who haven’t purchased from your brand before. Sponsored Brand ads show this metric, and we found it to be 69% of SB orders. That is a great rationale for active engagement on Amazon during Prime Day.

This recap was published on Jun 29, 2021. We keep our past years’ recaps online for future reference.

From the archive: 2021 Prime Day Recap

The dust has settled and now it’s time to share our Prime Day 2021 results!

Bobsled is one of the Marketplace Pulse Top 100 most important companies in the ecommerce marketplaces ecosystem, and we’ve been guiding our clients through Prime Day since 2015. In today’s post, we’ve aggregated some key Prime Day insights across our 80+ client accounts surrounding event participation, category trends, promo type preference, ad performance, and total sales. We have also shared some macro Prime Day insights from our ad tech partner Pacvue.

How does your brand’s Prime Day performance compare? Read on to find out!

What the analysts are saying

CNBC claimed that Prime Day 2021 was more muted compared to prior years. In 2020 Amazon disclosed that third-party sellers brought in $3.5 billion during the event, but this year Amazon opted not to share any hard numbers.

Adobe Analytics estimated that total Prime Day 2021 sales surpassed $11 billion, that’s a 6.1% growth compared to 2020. Some factors that impacted this year’s event include;

- Rising US inflation likely made some shoppers more cautious

- The current shipping crisis in China hurt supply chains

- Last year Prime Day took place in Q4 for the very first time. In 2021, the event returned to the summertime, which seemed to excite many shoppers. However, it is likely that many shoppers who spent big in 2020 were not in a position to spend as aggressively in 2021.

With that all being said, the Bobsled project team agrees that Prime Day 2021 sales were strong, aligning with our pre-event expectations.

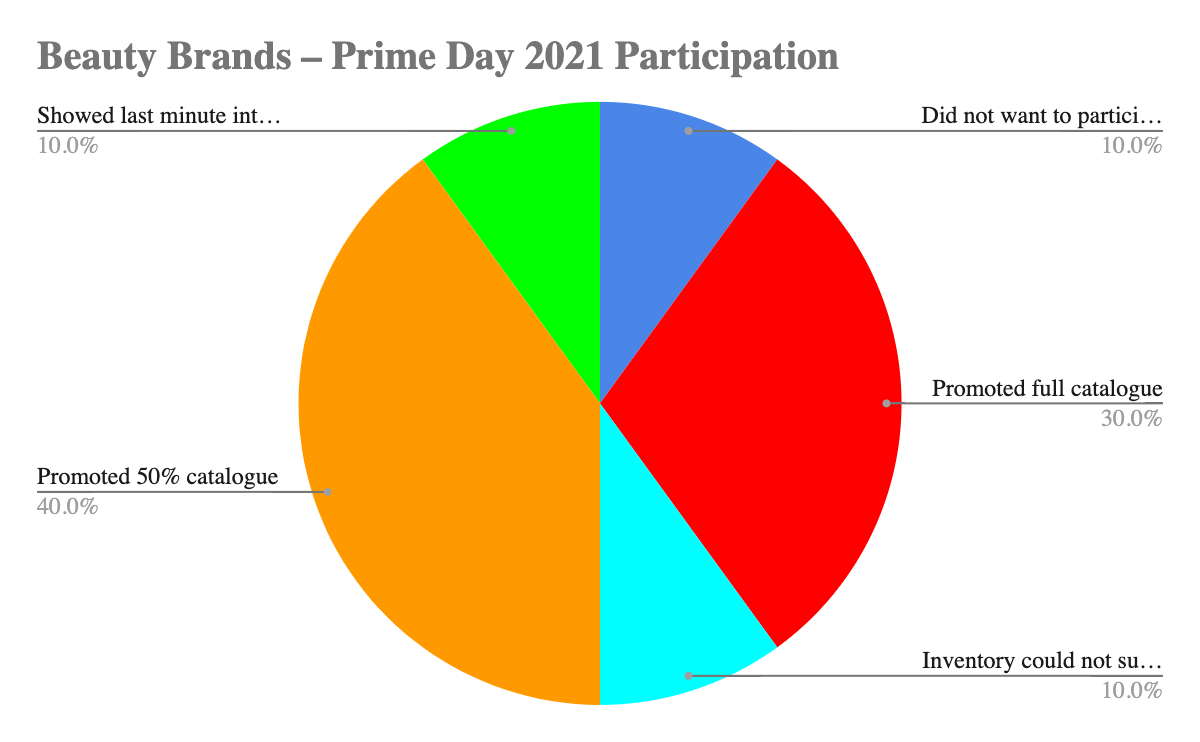

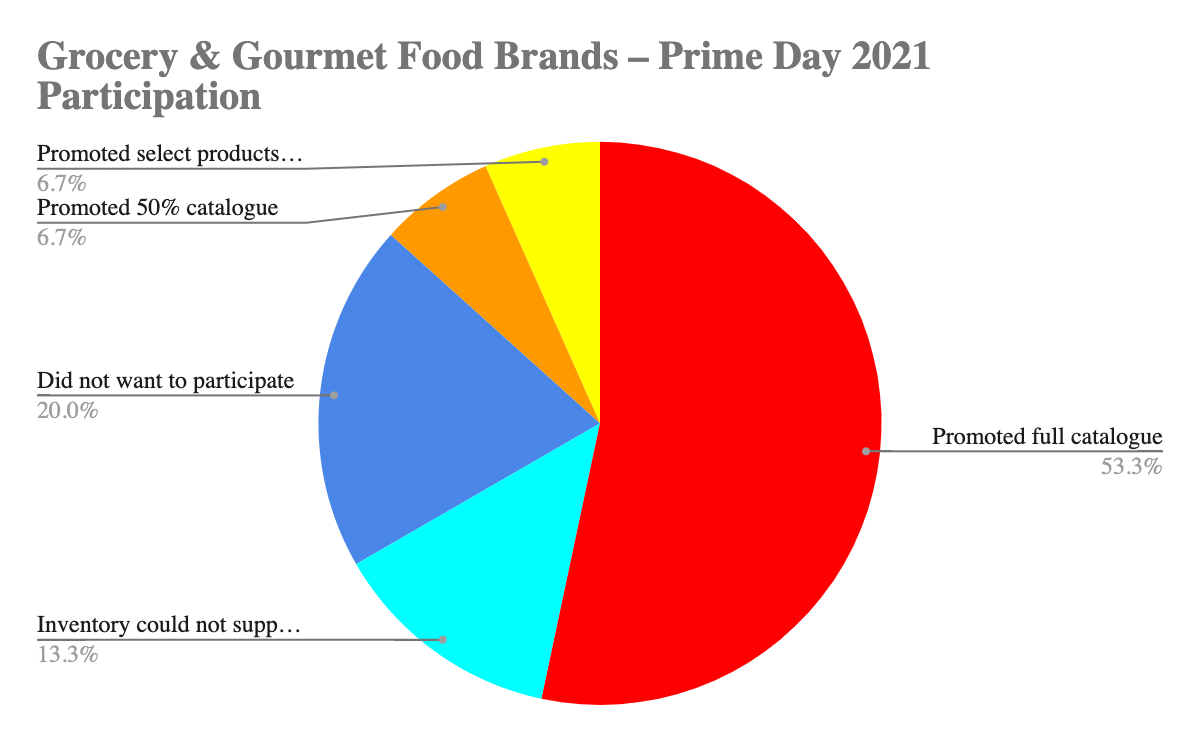

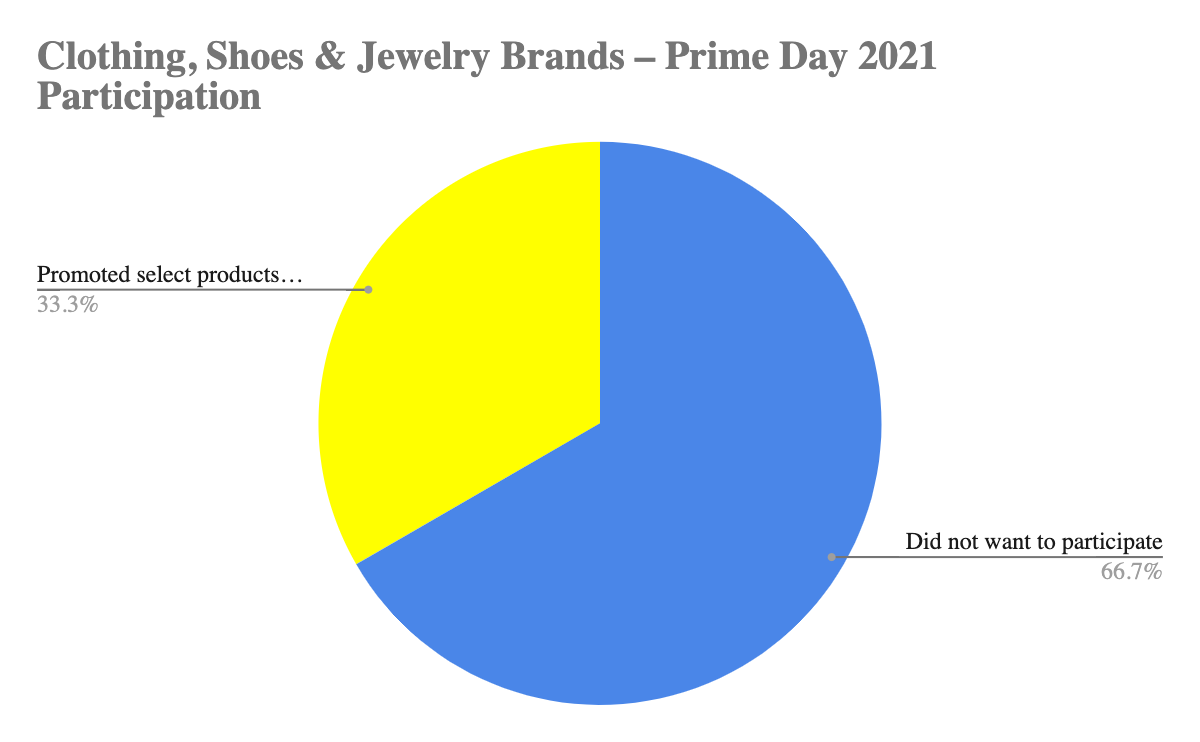

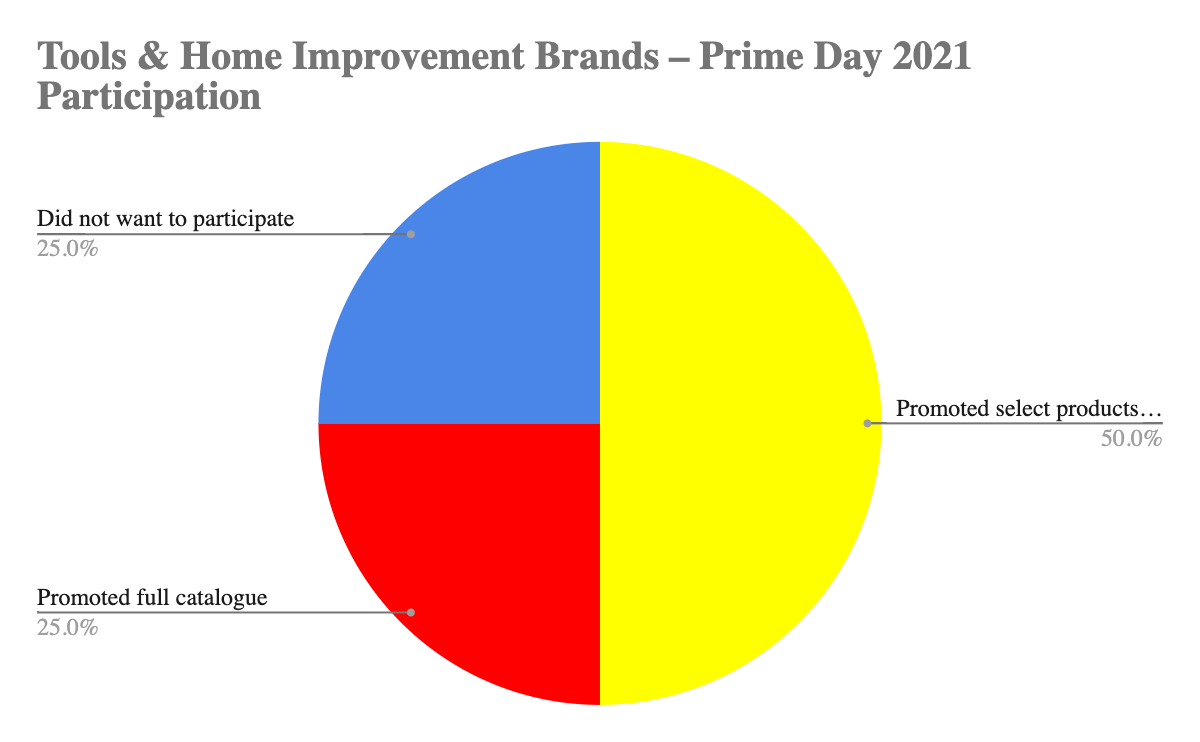

Prime Day 2021 – Bobsled Client Participation

Over half of Bobsled’s clients participated in Prime Day 2021 by running various types of promos. The vast majority of participating brands promoted their entire Amazon product catalog.

| Prime Day 2021 Approach | Percentage of Bobsled clients |

| Promoted entire product catalog | 30.9% |

| Promoted half of product catalog | 10.9% |

| Promoted best selling SKUs only | 16.4% |

| Showed last-minute interest | 5.5% |

| Low inventory levels prevented participation | 10.9% |

| Did not want to participate | 25.5% |

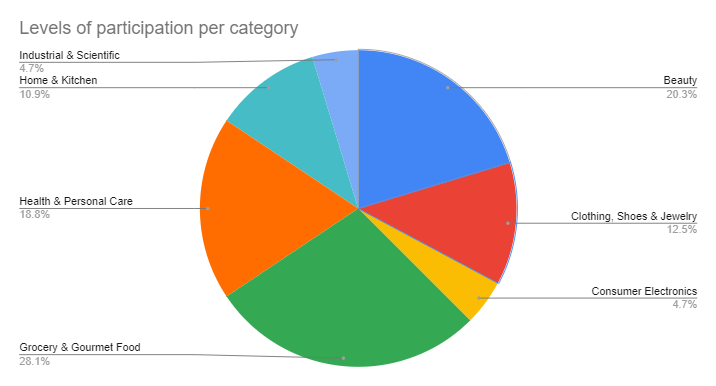

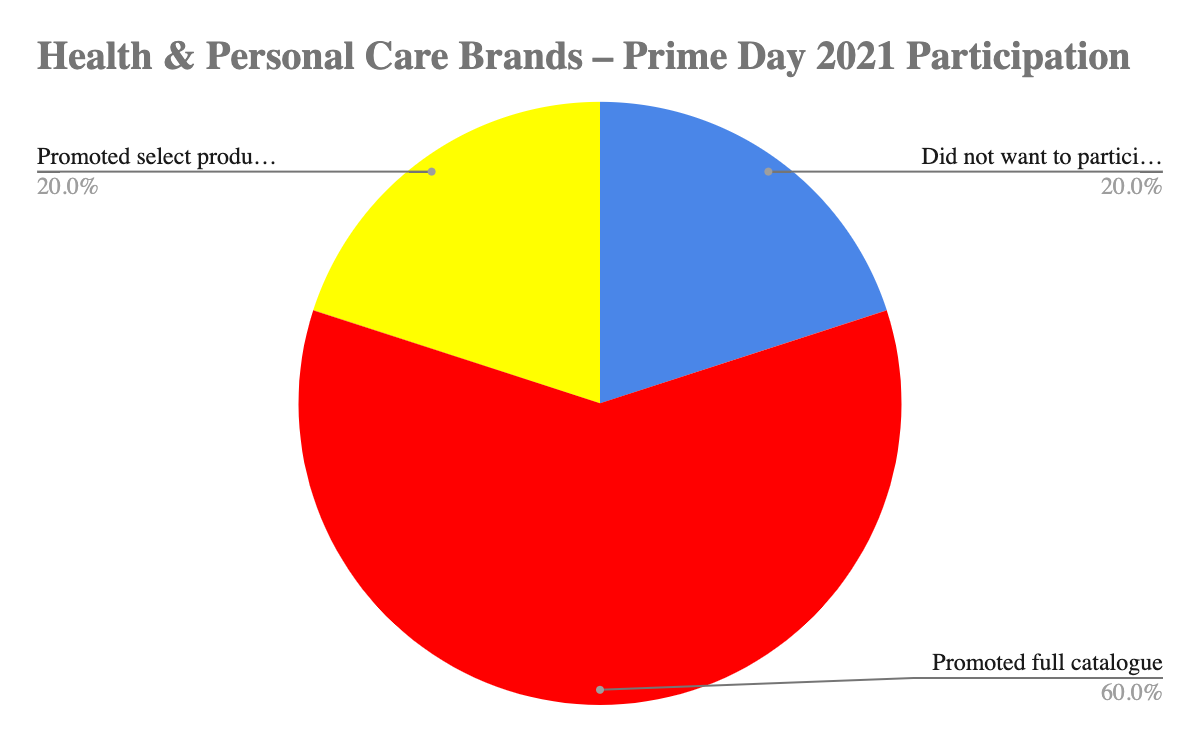

There were some noticeable differences in approach across categories. Brands selling within Health & Personal Care, Grocery & Gourmet Food, and Beauty were far more inclined to promote their entire catalog.

Brands selling within Tools & Home Improvement and Clothing, Shoes & Jewelry were more likely to ignore the event, and if they did choose to participate, they generally only promoted a handful of bestselling SKUs.

In terms of deal type, Coupons and Prime Exclusive Discounts (PEDs) were by far the most popular promos run by Bobsled clients.

Amazon Prime Day 2021 Performance Data

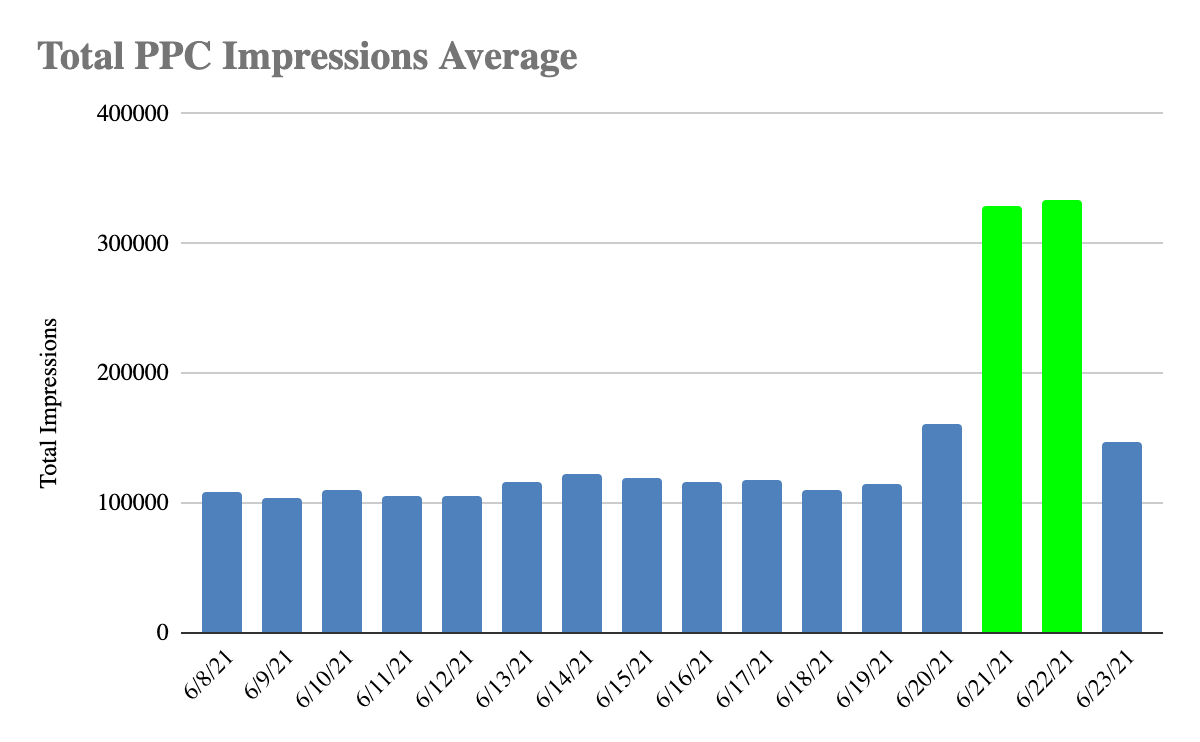

Average PPC impressions for Bobsled clients was 329,349 on Day 1 and 333443 on Day 2 of Prime Day. This marks an increase of approximately 283% from the rolling 14-day average.

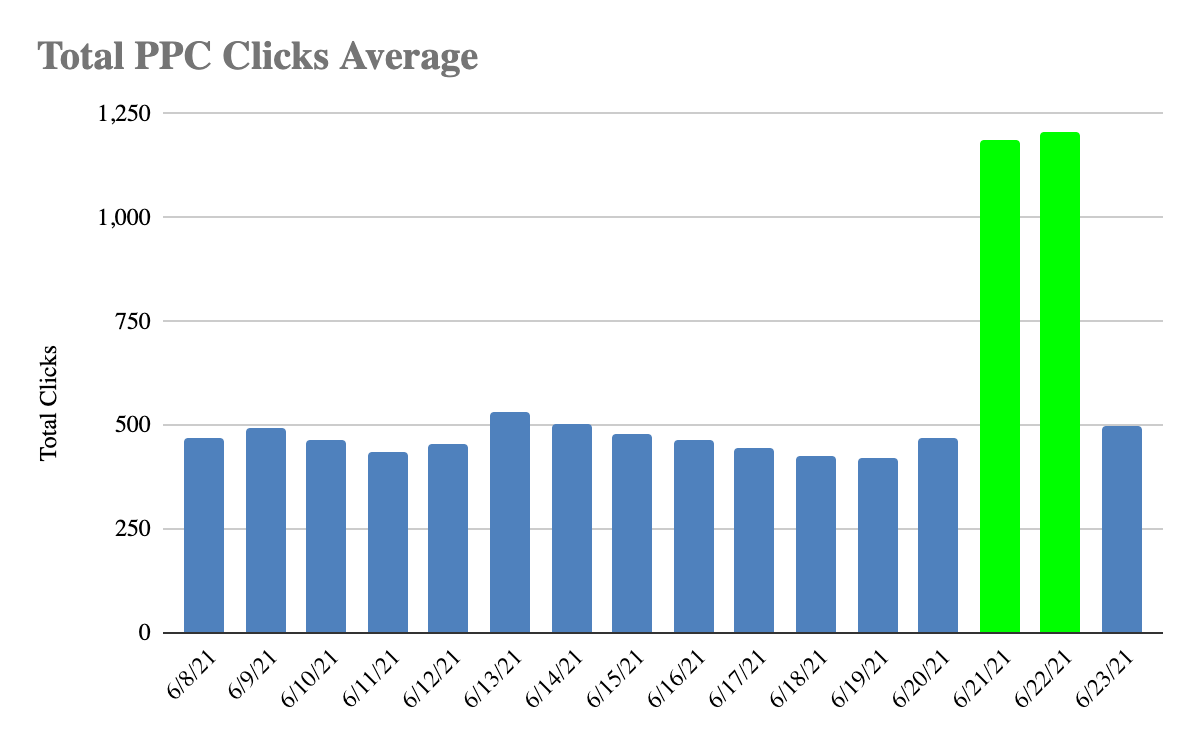

Average PPC Clicks for Bobsled clients was 1,185 on Day 1 and 1,205 on Day 2 of Prime Day. This marks an increase of approximately 255% from the rolling 14-day average.

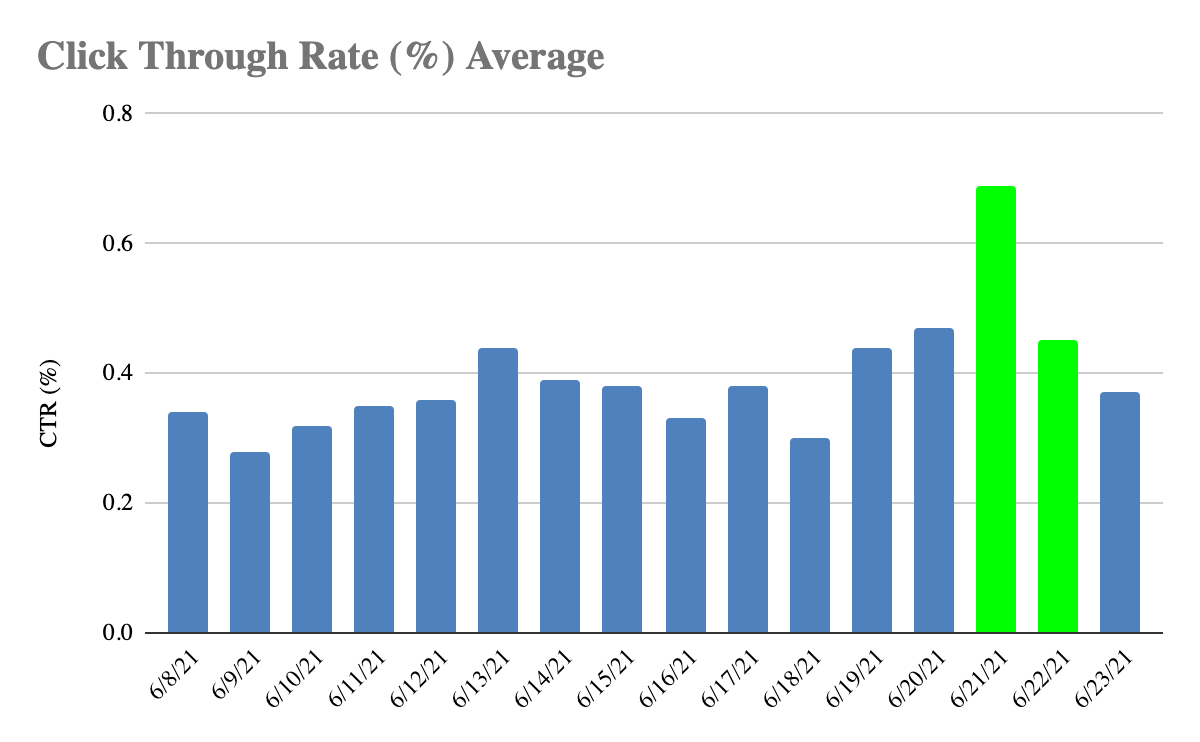

The average PPC CTR percentage for Bobsled clients was 0.69% on Day 1 and then this normalized to 0.45% on Day 2.

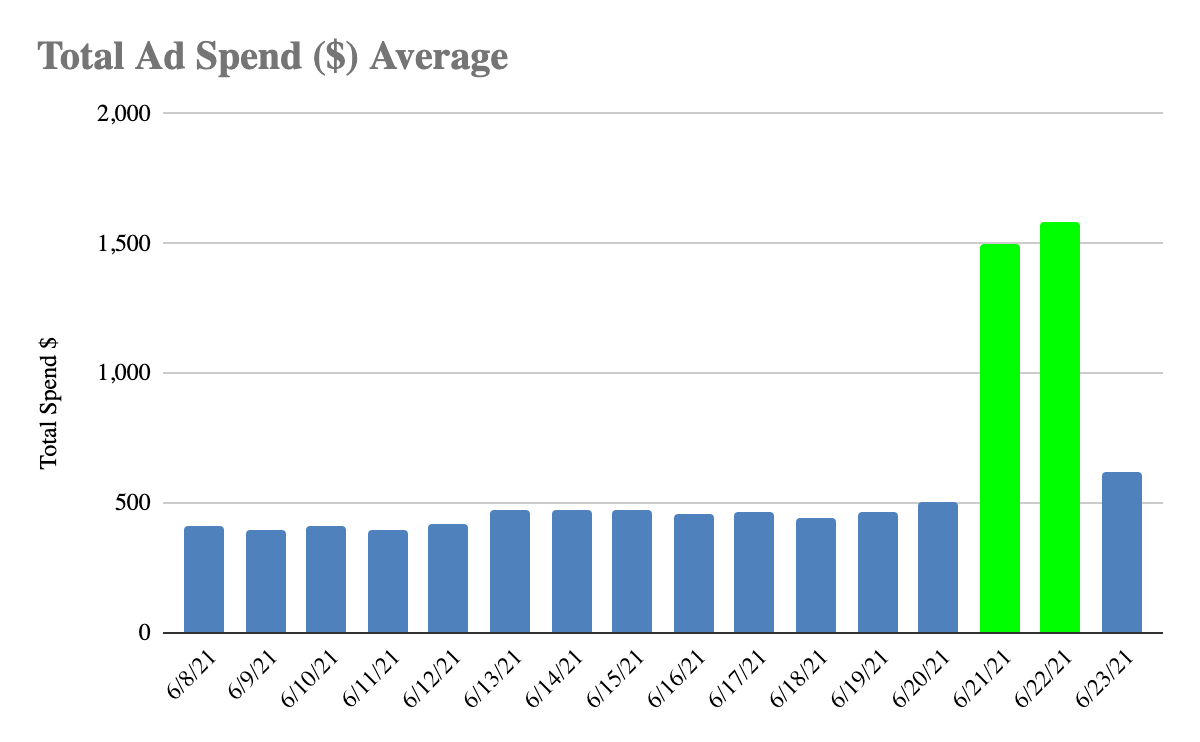

The average PPC Ad Spend for Bobsled clients was $1,499 on Day 1 and $1,583 on Day 2 of Prime Day. This marks an increase of approximately 338% from the rolling 14-day average.

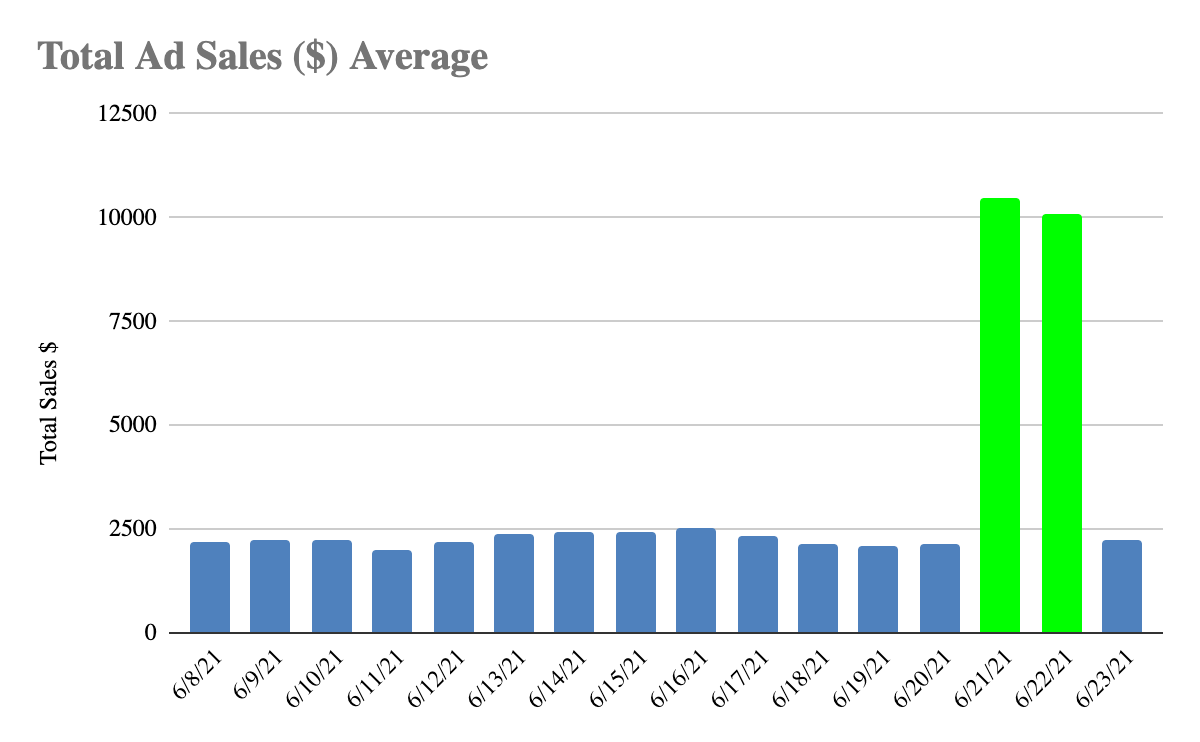

Average PPC Ad Sales for Bobsled clients was $10,478 on Day 1 and $10,065 on Day 2 of Prime Day. This marks an increase of approximately 464% from the rolling 14-day average.

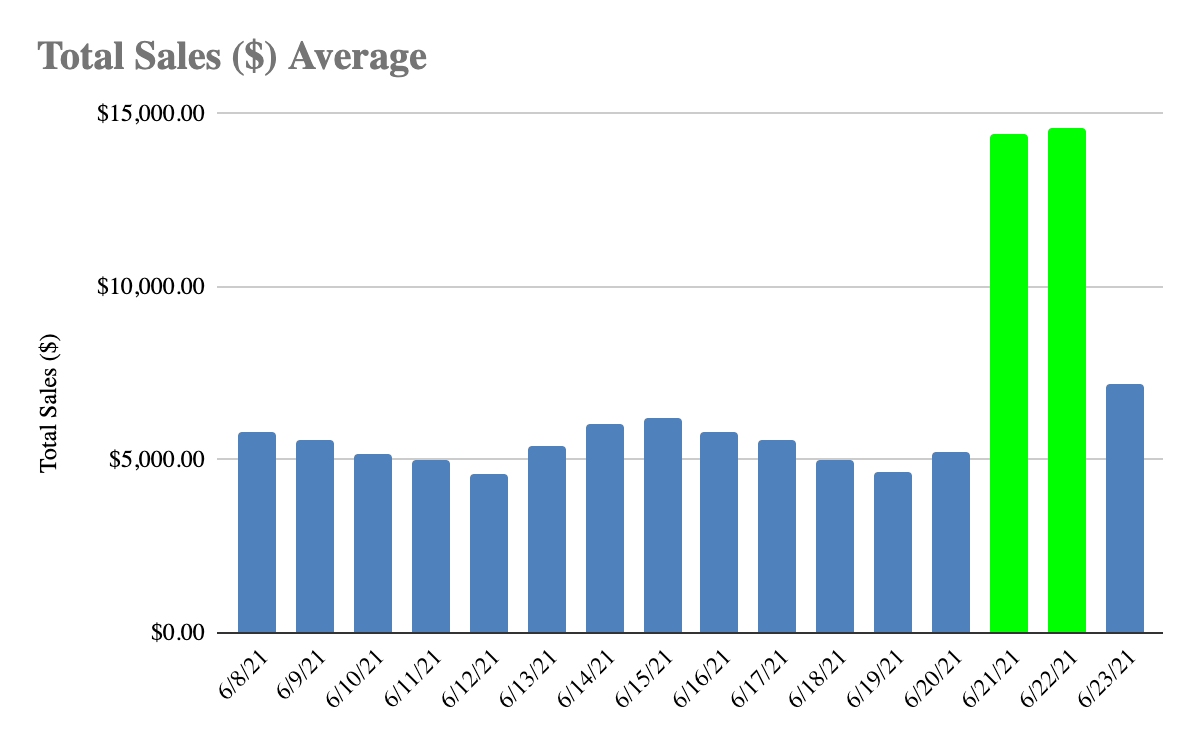

Average Total Sales for Bobsled clients was $14,393 on Day 1 and $14,573 on Day 2 of Prime Day. This marks an increase of approximately 267% from the rolling 14-day average.

Pacvue Prime Day 2021 CPC Report

The following information has been sourced from first-party data from Pacvue, Bobsled’s ad tech provider. It includes data from hundreds of advertisers across small, mid-sized, and large brands and every major product category.

Pacvue’s Key Prime Day 2021 Findings:

- Ad spend increased 38% year-over-year for Prime Day 2021.

- Broken out by ad type, ad spend increased 41% for Sponsored Products and 28% for Sponsored Brands year-over-year.

- ROAS declined 9% year-over-year for Sponsored Products on the first day of Prime Day. This is in line with the 6% year-over-year decline in ROAS seen in Pacvue’s Q1 2021 CPC report.

- ROAS increased 30% year-over-year for Sponsored Brands on the first day of Prime Day and increased 23% on the second day. This is a marked shift for Sponsored Brand ads, which have been declining in ROAS for three quarters and were down 12% year-over-year in Pacvue’s Q1 2021 CPC report.

- Many advertisers noted that Sponsored Brand Video performed particularly well this year, with increased placements above the fold and on product detail pages.

- CPCs increased about 25% year-over-year for Sponsored Products and were relatively flat for Sponsored Brands.

- While some leading brands have been experiencing supply chain issues and chose not to invest in Prime Day this year, many advertisers noted increased competition from smaller and emerging sellers, which pushed up the cost of advertising.

PRIME DAY HAS ENDED – WHAT NOW?

Brands that invested marketing and advertising budget into Prime Day should be looking to capitalize on the halo effect from the spike in sales. On the other hand, brands that didn’t participate are now playing catch up.

To figure out your next move, read our article from earlier this week – What Should Brands Do After Prime Day Ends?

If you need further assistance diving into your Prime Day numbers, don’t hesitate to book a free consultation below. The Bobsled team will be able to use our internal data sets to benchmark your performance compared to other brands selling within your category.