With contributions from Damiano Ciarrocchi, a PPC Manager, Armin Alispahic, a Team Lead, and Julian Galindo, a Project Manager at Bobsled.

In the land of Amazon, 2022 was a noisy, complicated year. We had multiple Prime Days, historic levels of inflation, and a newcomer to the e-commerce space in the form of TikTok.

At Bobsled, our clients are constantly asking us what’s next. What will advertising on Amazon look like next year? Which new features Amazon has rolled out should they be paying close attention to?

After some reflection, we asked our experts who focus on advertising, channel management, and branding about what they are expecting in 2023. Here are 6 predictions from our team.

Amazon Advertising predictions from Damiano Ciarocchi, PPC Manager

Video content should no longer be an afterthought.

Video has often seemed like a relatively niche part of the Amazon experience. A few years ago, Amazon didn’t even offer self-serve video ads. But recently, the company has introduced a raft of new ad formats focused on video. Amazon updated its Sponsored Brand video ads so these ads can direct viewers back to brand stores, for instance, and it added new Sponsored Display video ad units.At the same time, Amazon also began letting branded videos play in the search results. When you scroll through products on mobile, the videos play automatically.

example from Amazon.com, a screen recording by Julian Galindo

All of this means that brands can no longer ignore their video offerings. That goes for image content, too: in addition to video, you can now add custom images to Sponsored Display ads and Sponsored Brand ads. To differentiate themselves in 2023, brands will need to invest in high-quality custom creative content that they can place on their ads and highlight in search results.

Sponsored Display ads are getting an upgrade. At Unboxed, Amazon’s conference for advertisers, Sponsored Display (SD) ads took centerstage. Like DSP, Sponsored Display ads can target shoppers based on their behavior—their interests and lifestyles. But they have several limitations in other targeting techniques, and because of that, they are much cheaper than DSP ads.

Amazon seems focused on improving the value add of SD ads. Among other changes, brands can now offer rewards through SD ads. These rewards are redeemed as an Amazon shopping credit if a customer clicks the ad and makes a purchase. Amazon also began allowing non-endemic brands to use Sponsored Display for the first time.

Source: https://advertising.amazon.com/blog/unboxed-2022-sponsored-display-physical-store-ads

Source: https://advertising.amazon.com/blog/unboxed-2022-sponsored-display-physical-store-ads

As Amazon continues to push SD ads next year, I think SD will become even more attractive as a lower-cost alternative to DSP.

Amazon channel management predictions from Armin Alispahic, Team Lead

Brands and suppliers are bracing for a profit crunch.

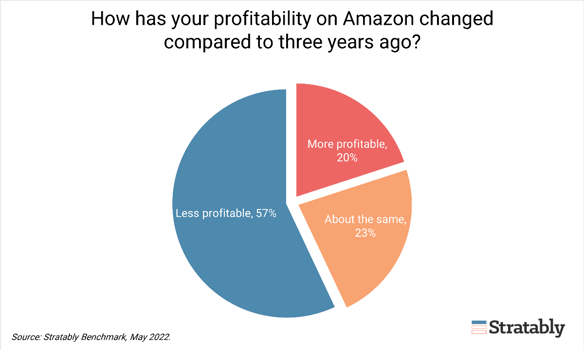

The combined forces of inflation and ballooning logistics costs seem poised to create a showdown during Amazon’s Annual Vendor Negotiations (AVN). Brands on Amazon have seen their profit margins shrink since the pandemic: 57% of Amazon brands say that their profits on the platform were lower in 2022 than three years prior (source: Stratably). Because of inflation, in some cases, profit margins have become so slim that many vendor businesses are at risk of closing.

The combined forces of inflation and ballooning logistics costs seem poised to create a showdown during Amazon’s Annual Vendor Negotiations (AVN). Brands on Amazon have seen their profit margins shrink since the pandemic: 57% of Amazon brands say that their profits on the platform were lower in 2022 than three years prior (source: Stratably). Because of inflation, in some cases, profit margins have become so slim that many vendor businesses are at risk of closing.

Source: Stratably.com

That’s why the upcoming vendor negotiations will be so critical. Vendors want to increase their prices on Amazon as a way to offset mounting costs—but to do that, they need to win Amazon’s approval. The vendor negotiations could have downstream effects for customers on Amazon, too. I expect that many vendors will try to play hardball with Amazon, and will refuse Amazon’s new terms until they can secure price increases.

Grocery is Amazon’s next battleground. Amazon is now the largest retailer in the U.S., but there’s one category in which it still trails behind its chief rival, Walmart: grocery. While Walmart controls nearly 25% of the U.S. grocery market in 2021, Amazon had just 1.2%, according to Euromonitor. The proposed acquisition of Albertson’s by Kroger - both of which operate 3rd party marketplaces and retail media networks - will put more pressure on Amazon’s nascent grocery business.

I expect that Amazon will continue to invest more in its grocery category next year in order to close that gap. Amazon has already been hiring a spate of vendor managers to manage its Fresh grocery channel, and we have experienced Amazon reps trying to convince our clients to expand their grocery catalog. I expect a flurry of activity on this front next year.

Further Interruptions to Amazon inventory. One thing I have my eye on for next year is Amazon’s continued struggle with warehouse capacity. Right now, in Q4 of 2022, Amazon has hit many sellers with a raft of severe inventory limits, which are restricting the number of products they can store in Amazon warehouses. Vendors too have also seen fewer product orders from Amazon, and more late pickups of their existing orders.

Meanwhile, Amazon’s “Born To Run” program—in which Amazon sources a large quantity of a product in advance from a vendor who is expecting that product to sell well, as a way to avoid out-of-stock issues—has become extremely selective. In my experience, most new products have been rejected from Born To Run recently.

All of this suggests that Amazon is in a crunch with either warehousing space or is limiting its capital allotment to inventory (or both). Neither of these challenges have easy fixes.

Amazon branding predictions from Julian Galindo, Project Manager

Social media will continue to influence the Amazon shopping experience.

.png?width=150&height=150&name=Copy+of+Copy+of+Bobsled+Frame+(7).png) As more and more shoppers discover products through their Instagram and TikTok feeds, Amazon has started revamping its browsing experience to mimic social media. Most prominently, Amazon borrowed from Instagram for Amazon Posts, its photo-based browsing features that shows up on product detail pages and category pages.

As more and more shoppers discover products through their Instagram and TikTok feeds, Amazon has started revamping its browsing experience to mimic social media. Most prominently, Amazon borrowed from Instagram for Amazon Posts, its photo-based browsing features that shows up on product detail pages and category pages.

Meanwhile, the #FoundItOnAmazon page looks a lot like a Pinterest board.

Source: Amazon.com

And at the end of 2022, Amazon also created Inspire, a video-discovery platform that looks a lot like TikTok and Instagram Reels. Influencers, shoppers, and brands can all post videos to Inspire, opening up a whole new ecosystem of video content on Amazon for businesses to prioritize.

Amazon’s attempts to bring a social-media-like interface to its app has implications for how brands think about their design. As Amazon begins to look more like Instagram, visual aesthetics are becoming more important than ever. Brands will need to invest in professional quality photos, videos, and graphic design.

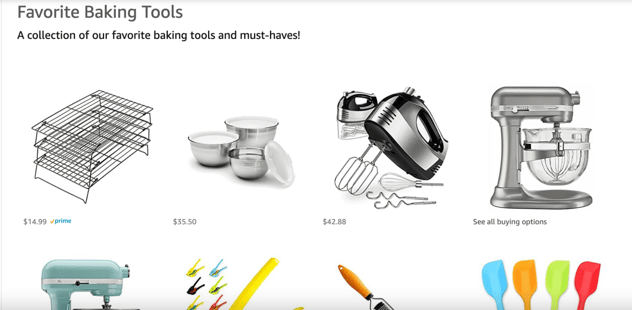

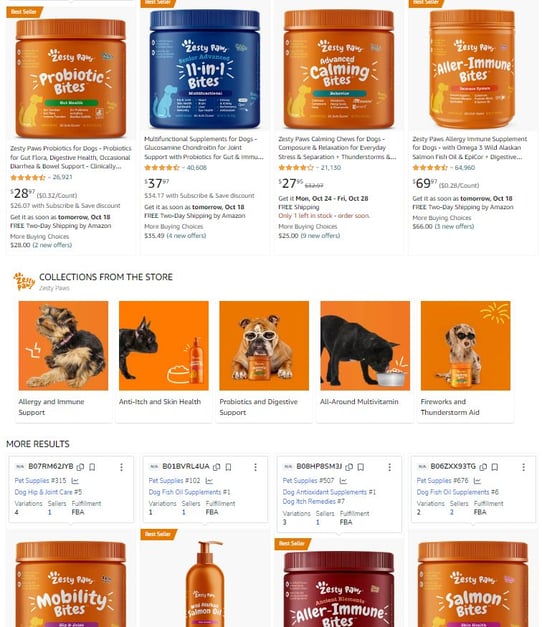

Your digital storefront on Amazon needs to be as thought-through as your DTC site. Every brand can create its own Amazon Store, a kind of digital homepage for each brand. Amazon Stores used to see negligible amounts of traffic, but Amazon seems to be making them a much bigger focus next year.

Stores can now host new kinds of content, including video content, and brands can also run ads that direct shoppers back to their storefront, rather than only to a specific product details page. Finally, storefronts have begun surfacing in search results.

Source: Amazon.com

Source: Amazon.com

We’re still learning why brand stores sometimes surface in search results. We do know that Amazon pulls the title of the subpage from a brand store, as well as a product from it.

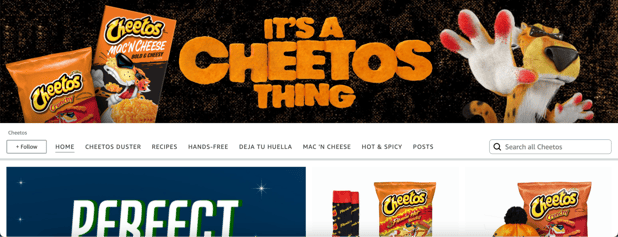

Some brands have even used their brand stores to link to increasingly elaborate activations. To promote its new Cheetos Duster tool, for instance, Cheetos created a sleek, scrolling campaign in partnership with Amazon that takes people through high-quality content of the new product. The Cheetos Duster is prominently displayed in the brand’s Amazon brand store.

Source: Amazon.com

Source: Amazon.com

By all accounts, Amazon will continue to push brand stores throughout 2023. Brands need to ensure their Amazon storefronts look like an extension of their DTC, with all the same sophistication and branding, and not an afterthought. Doing so will increase trust, credibility, and sales conversions.

Want more ecommerce news and best practices from our team? Subscribe to our weekly email newsletter, or subscribe to the weekly recap on LinkedIn from Julie Spear, our Head of Retail Services.

Tagged: Launching on Amazon, Amazon Account Management, Amazon Updates, amazon b2b

.png)