Damiano Ciarrocchi is a PPC Specialist at Acadia.

For most brands that sell on Amazon, the annual Prime Day event is one of the biggest days of the year. It’s crucial that brands looking to greatly benefit from Prime Day have a good advertising strategy for pre-, during, and post-Prime Day sales. With continuing supply chain issues and an increasingly tense Geo-political climate, it’s no wonder that even the most established eCommerce sellers are considering whether or not they should ramp up their ad spend or just go dark until the rush of the summer sales event is over.

This consideration has sparked quite the debate in 2022, showing that there are really only two viable options for dealing with Prime Day. Increasing ad spend can bring in new profits on the day of the summer sales event, but this should only be done if the brand can handle the financial requirements necessary to execute the campaign during and after Prime Day. Otherwise, it may be a better idea to go dark - whether a brand prefers to do that or not.

Finding The Best Way to Prepare for Prime Day 2022

Based on Amazon’s Prime Day 2021 Results and the rising costs of advertising, this year’s sales event landscape will look quite different than in years past. There are multiple market trends and supply issues that all brands should have in mind when trying to make the most informed decision. As I work with brands with varying degrees of Prime Day success, it’s becoming more clear which sellers could benefit from upping their advertising budget and which brands need to hold off on posting any major Prime Day deals.

Why the Big Debate?

As I stated above, there are several reasons why brands are contemplating either ramping up ad spending or completely going dark. There are a lot of new factors cropping up this year that brands didn’t previously have to contend with. Additionally, brands have more options than ever to allocate budgets to different places - but fewer ways to increase their monetary allowance. Understanding why Prime Day 2022 is going to look different than years prior is a big part of choosing the correct advertising strategy for your brand this summer.

Supply Chain Shortages

The effects of supply chain shortages and other shipping issues are still being felt across the globe, sending ripples of disorganization through even the most established distribution hubs. Since delays are to be expected both through AFS and off-Amazon options, it is all the more vital that brands think about an early Prime Day strategy.

Rising Advertising Costs

Additionally, the cost of advertising continues to increase. We’ve known for a while that TACoS (Total Advertising Costs of Sales) are going up incrementally each year, and it has reached the point where many small and emerging brands cannot afford to increase their budgets for Prime Day. It was once simpler for brands of all sizes to create a temporarily expanded budget strategy for Prime Day, but prices continue to climb for eCommerce in general.

Off-Amazon Platform Performance

Speaking of eCommerce in general, off-Amazon advertising has now become more important than ever. A significant number of brands are increasing awareness of their product on all off-Amazon platforms, including Instacart, Walmart, and their own online shopping pages. Those that advertise their products well before Prime Day are much more likely to rake in success from Amazon’s big event.

Should Brands Increase Their Ad Spend for Prime Day?

If a seller is going to beef up their budget in preparation for Prime Day, they need to understand that a successful Prime Day advertising strategy has to be planned out at least 5 weeks in advance and implemented a minimum of 3 weeks before the start of Prime Day.

Prime Day still remains as one of the two biggest sales events of the year (with the other being Turkey 5) and one of the best opportunities to really push products. It is possible for vendors to turn a massive profit as long as they have the correct strategy in place. At Bobsled, we like to recommend that vendors advertise both on and off Amazon, creating unique campaigns for both.

Our Omnichannel Playbook presses the rapid growth of eCommerce as an emerging profit center of the world. Those with the capacity to push more money into their off-Amazon budgets with enough time to spare are the most likely to see success from the event.

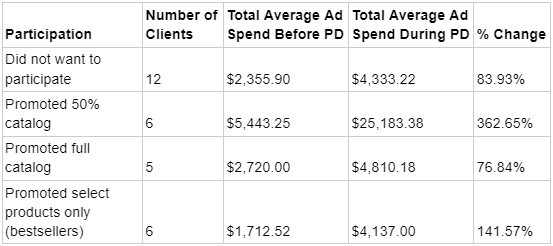

Prime Day 2022 Ad Spend Results Based on Client Participation

An extensive study on client participation in Prime Day 2021 illuminated several interesting results, further reinforcing the idea that a brand’s ad campaign must come with a game plan and an increased budget allocation if it is going to earn sweeping success.

Take a look at the data:

From last year’s results, we know that ad spend on a rolling 14-day average increased by 338%, while subsequent ad revenue was increased by 464%. Overall, that is a 37% increase in the rolling 14-day average ROAS.

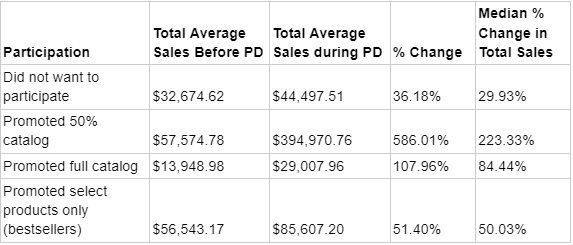

Based on both of the charts above, there are a few conclusive factors that I believe will directly inform our vendors’ decisions. First, it should be noted that the clients who promoted half (50%) of their catalog spend a lot more on advertising during Prime Day, increasing their spending by over 365.6%. Their total sales increased by a whopping 586% on average, with median sales coming in at 233.33%.

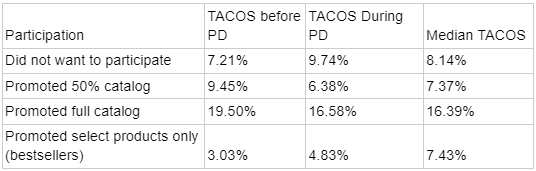

This means that the clients who promoted 50% of their catalog decreased their TACoS from 9.45% before Prime Day to 6.38% during Prime Day. This example may set a suggested course of action for several Premium beauty brands, as they typically experience a huge burst of total sales during the Prime Day event.

Comparing these results to those of the brands that only promoted a select amount of products, it is understandably essential to set an advertising expectation of at least 50% catalog promotion or more. Our clients that promoted less than half of their catalog saw an ad spend increase of 141.57%, while their total sales only increased by 50%. Overall, their TACoS increased from 3% to almost 5%.

But what about the clients who promoted their full catalog? Interestingly enough, they still saw an increase in profits and a lowered TACoS, but these changes were not as significant as those of the clients who promoted 50% of their catalog. Brands that pushed their entire inventory as part of their advertising campaigns saw a 76.84% increase in ad spend, with a total sales growth of about 84.4% throughout the Prime Day event.

How One Bobsled Client Increased Conversions Through Proper Planning

Recently, we sat down with one of our clients and studied what happened during the previous Prime Day and Turkey 5 events. We were able to create a successful strategy out of the results we found, making sure to solidify our ideas well in advance of the next major Amazon sales event. I wanted to incorporate some unique objectives and key results, such as:

- Understanding what happened during the last major Amazon sales events and why

- Making a succinct list of ASINs to purchase

- Increasing budgets so campaigns can be feasible without wasting dollars

- Creating a strong forecast of stock levels and inventory predictions

- Staying competitive by increasing CPCs

- Focusing on long-tail keywords to win top placements, only using broader keywords that have an above-average conversion rate

- Build a solid off-Amazon advertising strategy prior to Prime Day

All in all, awareness is key. By getting ahead of the game and studying last year’s materials, we were able to come up with a plan that set this brand up for success. With enough time in advance, it is possible for vendors to create successful advertising strategies without encountering any pitfalls.

How to Spend with a Fixed Budget

The number one reason why brands will ultimately decide to go dark instead of ramping up spending is simple: there is no available budget. This leads many sellers to wonder how they can compensate for increased advertising costs and growing demands for a stellar strategy that should be built up before, during, and after Prime Day. Fortunately, there are a couple of ways to increase your advertising efforts even with a super-tight budget.

Always Study the Data

A couple of years ago, we published 4 Things You May Not Know About Prime Day. One caveat that still holds true is that conversion rates tend to decrease in the days leading up to Prime Day, and this is something to be expected. This is due to people “window shopping” online, which can seriously alter search results and key metrics later on. It’s important to look at all of your important KPIs to determine how, where, and when you want to push your products with more advertising.

Create Detailed ASINs

My biggest recommendation is to be as detailed as possible with the ASINs you are looking to promote for Prime Day. With a small budget, it’s important to focus on the keywords with the highest conversion rate, which will give you the most bang for your buck. You can minimize wasted ad spend by avoiding broader keywords and pausing campaigns that don’t push your top performers. Even an extra $20 can go a very long way in placing your best sellers at the top of a customer’s search results page.

Thinking about your budget and your inventory can help you decide whether your brand should advertise an entire catalog or just 50% of it. What campaigns are already in place for a particular ASIN? How many are there? What are the brand’s biggest goals for Prime Day? The answers to these questions can guide sellers in making an informed decision about how to promote their catalog.

Should Brands Go Dark Instead?

Search volumes on Amazon have reached such incredible heights that even the biggest campaign budgets can burn out very early in the day. This is especially true for brands that are trying to advertise the same way that they normally would. It seems that many of our clients are spending more money for fewer conversions, which is undoubtedly discouraging for vendors struggling to add more to their budget as it is.

This is why a lot of brands are going dark for Prime Day, even if this action wasn’t part of their original campaign plan. With many global crises surfacing at once, such as the lockdown in China and the continuing war hostilities in Ukraine, the supply chain is proving itself to be consistently unreliable. With shipping and distribution in such a volatile state, many brands are choosing to go dark for a sense of security.

Minimal Growth from 2021 is Disheartening

Prime Day 2021 was nothing short of underwhelming for both brands and consumers on Amazon. A CNN report published a dismal 7% growth from 2020, with gross merchandise sales coming in at $9.5 billion. When you marry this reality with the fact that CPCs are increasing about 25% year-over-year for Sponsored Products, it’s no wonder that sellers are looking to sit this Prime Day out.

An overflow of competition is the icing on the cake, making a lot of small or newer vendors feel like they don’t have the time or finances to do what it takes to enjoy increased sales over the course of the summer event. Sponsored Brands aren’t getting a lot of positive feedback from sales events over the last few quarters, causing a lot of them to go dark as the only hassle-free strategy available.

Bobsled Encourages Clients to Spend Their Way Through Prime Day

I once had one of my clients, who is a large seller in the Home & Kitchen category with over 100 SKUs in inventory, refuse to spend more on advertising due to budget restrictions. They saw that their campaigns were running out of budget money very early in the day, convincing them that the entire ad strategy was just a waste of funds.

Unfortunately, this resulted in higher-than-average TACoS throughout the summer sales event, and their conversion rate dropped by a few percentage points. I believe that they gained the initial traffic they needed to increase profits, but when customers returned to make the purchase, the products they were looking at could no longer be found in the same advertising spots that they were sitting at earlier in the day.

Going Dark Still Raises Costs

While the vendors that ultimately decide to go dark typically do so for financial reasons, it is very important to note that it is still possible to raise your TACoS when you go dark. Take a look at the following information pulled from our Prime Day 2021 client participation study:

Brands that chose not to participate in Prime Day advertising still saw an increase of ad spending by almost 84%. This happens for various reasons, from increased traffic to an intentional strategy capitalization. The more people click on ads, the more the advertising will cost. These brands did see an average increase in revenue by 36%, still marking Prime Day a profitable event. But with the median TACoS coming in at 29.93%, it shows that their Total Advertising Cost of Sales still went up.

Is Prime Day Ad Spending Right for You?

I predict that sellers and vendors who are already set up in preparation for Prime Day ad spending will be the most successful. Those who have a clear strategy before, during, and after the sales event are the most likely to significantly lower their TACoS while increasing overall conversions and sales.

A clear advertising strategy will usually have a clear understanding of when and where to start advertising, holding a strong budget for the 3-4 week period that surrounds Prime Day each year. It is also integral to have clear KPIs for each phase, know which ASINs to push, and have a full suite of campaigns to push these products constantly. It never hurts to have a current DSP advertising strategy or at least one Sponsored Display. Don’t forget about off-Amazon promotional opportunities as well!

While some sellers might not want to participate in Prime Day due to higher CPCs and lower rates of return, Prime Day still remains one of the best annual opportunities to sell products and grow a larger customer base. The mark of a great Prime Day performance is not only in sales but in generating new-to-brand customers. For many shoppers, this is the first time they will encounter your brand. You need to make a good first impression so those initial clicks turn into full conversions.

Bobsled can help you make the smartest move for your brand for this and future Amazon Prime Day events. If you are looking for more crucial advice in the weeks leading up to Prime Day 2022, keep your eyes on this guide and refresh yourself on our Prime Day 2021 Predictions and Last Minute Tips for Brands, as most of this information is still relevant to future Amazon sales events.

Learn whether to push your ad campaign or go dark for Prime Day by scheduling a free consultation with our experts!